The Swiss Bankers Association SwissBanking recommends its members to certify their client advisors according to the standards of the personal certification SAQ Swiss Association for Quality. These are certifications accredited by the Swiss accreditation body SAS according to EN ISO/IEC 17024.

The increased demands of clients for advice and the constantly changing situation on the financial markets require client advisors to be highly competent and agile. The common, industry-wide SAQ standard for client advisors offers banks the best environment for mutual recognition, trust and global exchange of personnel. The SAQ Swiss Association for Quality, as an established, neutral and accredited personal certification body, offers an attractive solution for the entire banking industry with its certification system Client Advisor Bank.

Currently over 70 banks from all banking groups participate in the personal certification system. These cover about 75-80% of all customer advisors. In addition to the client advisors of Swiss banks, advisors of external asset managers are also admitted to the system.

Facts and Figures Client Advisor Bank

| 2012 | First certificate issued |

| 17000 | Valid certificates |

| 6 | Certification programmes |

| 19 | Countries where exams were carried out |

| 1200 | Mandated exam experts |

| 75 | Participating banks and various independent asset managers |

| 8 | Mandated exam providers |

| 55 | External providers of recognised recertification measures |

Documents

Downloads

| Recommendation of the Swiss Bankers Association (SBA) | PDF (164.5 kB) |

| Factsheet: Client Advisor Bank | PDF (145.4 kB) |

Financial institutions directly involved

|

|

The certification system Client Advisor Bank

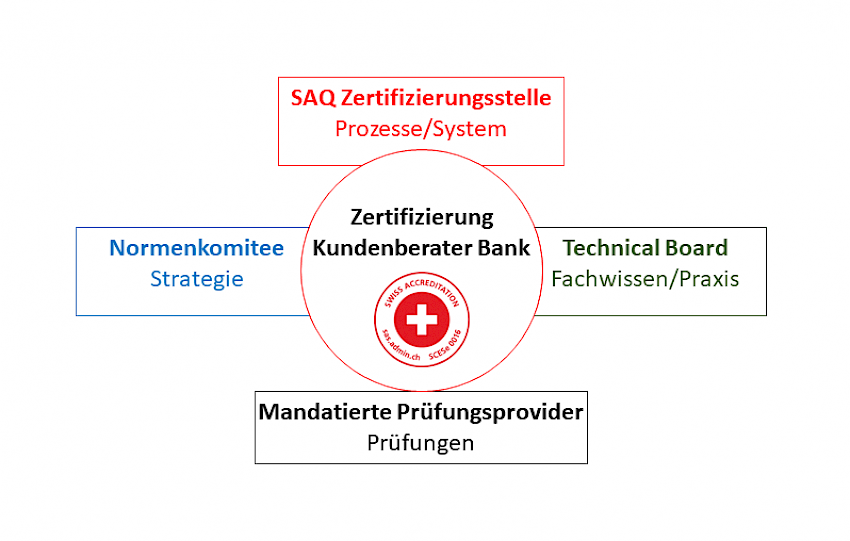

Thanks to the close cooperation between the banking industry and the certification body SAQ, the certification system is constantly being developed and adapted to changing practical conditions.

The industry understands the professional skills, social and methodological competencies and government requirements that its client advisors must meet in order to provide its clients with a high-quality advisory experience. The certification body implements these standards together with the mandated exam providers.

Moreover all aspects of the topic of “ESG” were explored in greater depth and the requirements for client advisors have also been increased. Thanks to the cooperation with Swiss Sustainable Finance (SSF) on revising the knowledge requirements for sustainability, the goals set were clearly achieved, yielding various benefits. More information in our media release.

SAQ Certification Body

The certification body SAQ is the owner of the certification system and is responsible for the implementation of the processes according to the accredited standard ISO/IEC 17024. It coordinates all committees and stakeholders within the system and implements the decisions from the standards committee in accordance with the standards.

Furthermore, SAQ is responsible for monitoring the audit processes of its audit organisations. As an independent certification body, SAQ makes all certification and recertification decisions and then issues the certificates.

Standard Committee

The standard committee provides the strategic direction. Requirements and qualification procedures are defined and decisions are made regarding proposals for improval by the Technical Boards. The "Client Advisors Bank" Standards Committee includes representatives of the major banks UBS and Credit Suisse, the Lucerne Cantonal Bank for the cantonal banks, Valiant Bank for the regional banks, Raiffeisen Switzerland for the Raiffeisen banks, Bank Julius Baer for the stock exchange banks, Banque Pictet SA for the private banks, PKB Privatbank for the foreign banks, Postfinance for other banks, as well as the Swiss Bankers Association.

Technical Boards

The Technical Boards are the professional conscience of the certification. They validate and support the further development of the respective programme content, the learning topics and the Body of Knowledge in terms of subject matter and content, and develop a basis for decisions on adjustments of technical and content nature for the attention of the "Client Advisor Bank" Standard Committee. In addition, the Technical Boards carry out expert opinions and conformity tests for new exam providers or quality checks.

In the certification system "Client Advisors Bank", three specialised Technical Boards are in place for the areas of wealth management, retail and corporate banking. All banking groups represented in the Standard Committee are expected to send a representative to this board.

Mandated exam providers

The mandated exam providers carry out all qualification procedures in the certification system on behalf of SAQ. In doing so, they are responsible for the preparation, organisation, implementation, evaluation and reporting of the results of the audit and thus make a major contribution to the success of the certification system.

There are public exam providers such as bbz, Fintelligence, FitchLearning, Optimus and ISFB, as well as internal exam providers like Bank Julius Baer, Banque Pictet and UBS. They are all monitored and audited by SAQ.

Swiss Accreditation Service SAS

The SAS is part of the Department of Economy, Education and Research and is attached to the State Secretariat for Economic Affairs SECO. The Swiss Accreditation Service SAS assesses and accredits certification bodies on the basis of international standards.

The certification system for bank client advisors is accredited by the SAS according to the international standard for personal certification ISO/IEC 17024.